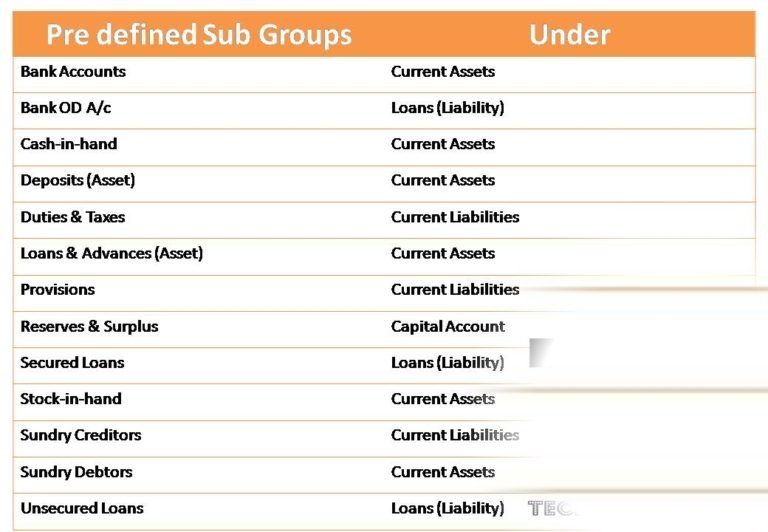

Account Groups with full details based on the requirements of accounting system, tally provides a set of 28 predefined groups, of those 15 are primary groups and 13 are sub-groups. the group and ledger accounts can be created under each group is given below. accounts.

account groups with full detail

1) Capital Account :-

A primary group to hold capital and reserves & surplus of the company. ledger accounts like preference and equity share capital, partners capital and drawings, proprietors capital and drawings belong to this group. it has one sub group – reserves and surplus.

a) Reserves & Surplus (Retained Earnings):-

All reserve accounts, which are also recognized as retained earnings, are placed under this group ledger accounts like general reserve, capital reserve, investment allowance reserve, share premium accounts are placed under this group.

2) Loans (Liability):-

This Is A Primary Group To Place All Loan Accounts. It Has Three Sub Groups – Bank OD A/C (Bank OCC A/C), Secured Loans And Unsecured Loans.

a) Bank OD A/C (Bank OCC A/c):-

The ledger accounts related to Bank Overdraft, Cash/Credit accounts, Hyphenation A/c, Bill Discounting A/c are created under this sub group.

b) Secured Loans:-

The ledger accounts of term Loan and other Medium/ Long term loans taken by the company from banks, financial institutions upon furnishing security must be placed under this sub-group. debentures issued by the company can also be placed under this sub-group.

c) Unsecured Loans:-

The ledger accounts of loans received from outside parties, directors, friends and relatives, to whom no security is provided are created under this sub-group. deposits received by the company from others can also be placed under this sub-group.

3) Current Liabilities:-

This is a primary group to hold the outstanding and statutory liabilities of the company like outstanding expenses, contribution for ESI, PF, TDS, Professional tax of employees or contractors deducted from their salary, should be placed under this group. it has three sub groups.

a) Duties & Taxes :-

For all tax accounts like Goods service tax, VAT, EXCISE, CST and other trade taxes.

b) Provisions:-

It is used to hold all provisions like provision for taxation, provision for bad debts, provision for dividend etc. but provision for depreciation a/c will be created under the group fixed assets.

c) Sundry Creditors :-

All trade creditors of the company, generally suppliers account, with whom transactions are entered through purchase vouchers, Debit Note and Journal should be placed under this sub-group Advances given to suppliers can be kept in individual ledger account of suppliers under this sub-group.

4) Indirect Expenses (Expenses Indirect):-

This is a primary group to record all expenses paid by the company for office, maintenance, selling and distribution like Advertisement, Rent, Traveling Expenses, Maintenance & Cleaning Expenses, General Repairs, Staff Welfare Expenses, Salary, Electricity Expenses, Telephone Expenses, Printing and Stationery, Postage & Stamps, Depreciation for current year, payment for rent, Commission, Interest on Loans etc. Company’s share of contribution to PF, ESI etc. can be created under this group.

5) Direct Expenses (Expenses Direct):-

This is a primary group to hold the ledger accounts of all trading expenses like carriage inwards, Unloading Charges, wages, coolie, power and fuel, freight inwards, Handling Charges, Scrap Sorting Charges etc. can be created under this group.

6) Direct Income (Income Direct):–

It is a primary group to hold the ledger accounts of income, Which will be used to calculate Gross Profit. Professional Servicing Charges, Servicing Charges etc. can be created under this group.

7) Indirect Income (Income Indirect):-

This is a primary group to record all rent, Interest on Deposits, Commission, Dividend etc. received. Packing and Forwarding Charges, Distribution charges collected from the customers.

8) Fixed Assets:-

This is a primary group to hold the ledger accounts of all fixed assets (plant, machinery, building, furniture & fittings, land, vehicle etc), Immovable properties, patents, trade rights, goodwill, accumulated depreciation (having credit balance can also be placed under this group to have original cost and accumulated depreciation for fixed assets separately), live stock like horse, elephant, camel etc.

9) Investment :-

This is a primary group. ledger accounts like investments in shares, bonds, debentures of other companies and Government securities are placed under this group.

10) Misc. Expenses (Asset):-

It is a rarely used primary group. According to Schedule VI of the Companies Act, all preliminary, preoperative expenses that have been capitalized to the extent of not written off in Profit and Loss accounts are placed under this group.

11) Suspense Account:-

This is a primary group, which appears in Balance Sheet. It is used to create any suspense ledger account to record amount paid or received temporarily or whose nature of transaction is not yet known like Traveling Advance, can be created under this group.

12) Sales Accounts :-

This is a primary group to record regular business sales and sales returns (not sale of fixed assets) Generally, different sales A/c’s like sales @ 1%, sales @ 4%, sales @12.5%, sales exempt A/c and sales Returns A/c will be created under this group. Discount on sales called trade discount must be created under the group sales accounts.

13) Purchase Accounts :-

This is a primary group to hold all regular business purchases and purchase return (not purchase of fixed assets for office use). Generally, different Purchase A/c’s like Purchase Exempt A/c, Purchase @ 1%, Purchase @ 4%, Purchase @ 12.5%, Purchase from Unregistered Dealers and Purchase Returns A/c are created under this group.

14) Branch/Divisions:-

This primary group is used by multi-branch companies for inter branch reconciliation and consolidation. the companies Branches, Divisions, Affiliates, Sisters Concerns Subsidiaries etc, can be placed under this group .

15) Current Assets :-

This is a primary group to keep the assets of the company generally ledger accounts are created under its six different sub groups.

a) Stock-In-Hand:-

It is used to hold opening and closing stock figures of some accounts like Raw Materials, Work-in-Progress and finished Goods. When maintaining accounts with inventory, as closing stock is automatically calculated, this sub groups is not used. it is used in case of accounts only. these accounts cannot be used in voucher entries. the closing balance of this sub-group ledger accounts must be entered through ledger accounts alteration only.

b) Deposits (Assets):-

Ledger accounts related to deposits made by the company (not deposits received by the company) like Fixed Deposits, Recurring Deposits, Security Deposits in other companies, rental deposits, Deposits with Electricity Department, Deposits with Telephone Department etc. can be created under this sub-group.

c) Loans & Advances (Asset):-

All advances of non-trading nature like salary advance, Loans to employees, all short term loans given by the company, advance to purchase fixed assets etc. can be placed under this sub-group.

d) Sundry Debtors:-

Ledger account of customers (all parties to whom credit sales are made) is created under this sub-group. Advances received from customers can also be kept under this sub-group.

e) Cash-in-Hand :-

Cash A/c is created automatically by Tally when the company is created, under this sub-group. ledger accounts like petty Cash A/c, Cash at Branch A/c etc. can be created under this sub-group.

f) Bank Accounts:-

All Current and saving bank accounts are created under this sub-group.

I hope that you understand my post. if you like this post then share my post, and comment on my post if you have any suggestion or Queries related to accounts. Thank you!